3 Simple Techniques For Hsmb Advisory Llc

Table of ContentsHow Hsmb Advisory Llc can Save You Time, Stress, and Money.Hsmb Advisory Llc Fundamentals ExplainedThe smart Trick of Hsmb Advisory Llc That Nobody is DiscussingRumored Buzz on Hsmb Advisory LlcThe Single Strategy To Use For Hsmb Advisory LlcThe 7-Second Trick For Hsmb Advisory Llc

Ford states to stay away from "money worth or permanent" life insurance policy, which is even more of a financial investment than an insurance coverage. "Those are very made complex, featured high payments, and 9 out of 10 individuals do not need them. They're oversold because insurance representatives make the biggest commissions on these," he says.

Handicap insurance can be pricey. And for those that opt for long-lasting care insurance policy, this policy might make special needs insurance unneeded.

What Does Hsmb Advisory Llc Mean?

If you have a chronic wellness issue, this kind of insurance coverage could end up being critical (Life Insurance). Do not allow it worry you or your bank account early in lifeit's typically best to take out a policy in your 50s or 60s with the expectancy that you will not be using it up until your 70s or later on.

If you're a small-business owner, consider safeguarding your livelihood by acquiring business insurance. In the event of a disaster-related closure or duration of restoring, business insurance can cover your income loss. Consider if a significant weather condition occasion impacted your shop or production facilityhow would certainly that influence your revenue? And for the length of time? According to a report by FEMA, in between 4060% of local business never ever reopen their doors following a disaster.

And also, making use of insurance could in some cases cost even more than it conserves in the lengthy run. If you obtain a chip in your windshield, you may consider covering the repair expense with your emergency financial savings rather of your vehicle insurance policy. Why? Due to the fact that utilizing your auto insurance can cause your monthly premium to go up.

Indicators on Hsmb Advisory Llc You Need To Know

Share these pointers to protect liked ones from being both underinsured and overinsuredand talk to a trusted expert when required. (https://hsmbadvisoryllc.godaddysites.com/f/health-insurance-in-st-petersburg-fl-your-ultimate-guide)

Insurance policy that is bought by an individual for single-person coverage or insurance coverage of a family. The individual pays the costs, as opposed to employer-based health insurance coverage where the employer commonly pays a share of the costs. Individuals might buy and purchase insurance coverage from any strategies available in the individual's geographical region.

People and households may receive financial assistance to lower the cost of insurance policy costs and out-of-pocket expenses, however only when registering via Connect for Health Colorado. If you experience specific changes in your life,, you are qualified for a 60-day amount of time where you can sign up in a specific strategy, even if it is beyond the annual open registration duration of Nov.

Hsmb Advisory Llc for Dummies

- Connect for Health And Wellness Colorado has a full listing of these Qualifying Life Events. Reliant children that are under age 26 are eligible to be included as relative under a moms and dad's protection.

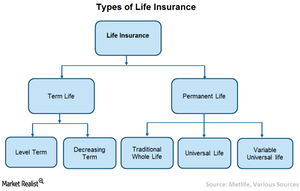

It may seem basic however understanding insurance types can additionally be puzzling. Much of this confusion comes from the insurance market's recurring objective to design customized coverage for insurance holders. In developing flexible plans, there are a range to choose fromand every one of those insurance kinds can make it tough to recognize what a specific policy is and does.Hsmb Advisory Llc Fundamentals Explained

If you die during this duration, the person or people you have actually named as recipients may obtain the cash money payment of the plan.

Several term life insurance plans allow you convert them to a whole life insurance coverage policy, so you do not shed protection. Commonly, term life insurance policy plan premium settlements (what you pay each month or year into your policy) are not locked in at the time of acquisition, so every five or 10 years you have the plan, your costs can rise.

They also often tend to be cheaper overall than whole life, unless you purchase a whole life insurance coverage plan when you're young. There are additionally a couple of variants on term life insurance policy. One, called group term life insurance policy, is usual amongst insurance coverage choices you may have access to with your employer.The Hsmb Advisory Llc Ideas

An additional variation that you may have accessibility to with your company is additional life insurance policy., or burial insuranceadditional insurance coverage that could aid your visit this site family in instance something unforeseen happens to you.

Long-term life insurance just refers to any type of life insurance policy that doesn't expire.